Building a Bridge for Your Financial Dreams

Xtramile Financial Group’s goal is to guide business owners, high-net-worth individuals and retirees to their ideal version of financial fulfilment. At Xtramile Financial Group, we understand that after-tax wealth is what truly matters, and our team of professionals will go the Xtramile to create a game plan designed to help optimize for your financial goals. See Our StoryOur Comprehensive Capabilities

Our team specializes in finding ways to help you reach your financial goals, using the full spectrum of coordinated financial services, including tax-focused strategies for real estate investing, estate and retirement planning, risk management and more. Together with the professionals at Mariner, our team leverages decades of combined experience to assess your business and personal financial strategy to create a roadmap that serves your specific objectives. Wealth doesn’t happen by chance–our guidance seeks to lay the groundwork for reaching your goals, whether you’re building a real estate empire or leaning into long-term investments.

Real Estate Investing

Investing is never static–even when you’re waiting, there are many factors at play. Xtramile’s team of professionals focuses on finding ways to maximize every part of the process, including tax planning and strategy to help you make the most of your investments. If real estate investing is part of your strategy, there are tools available, such as 1031 Exchanges, 721 UPREIT Exchanges and Qualified Opportunity Zones, that can help minimize your tax burden and transition smoothly between active and passive investment vehicles.

Trading for Tax Relief

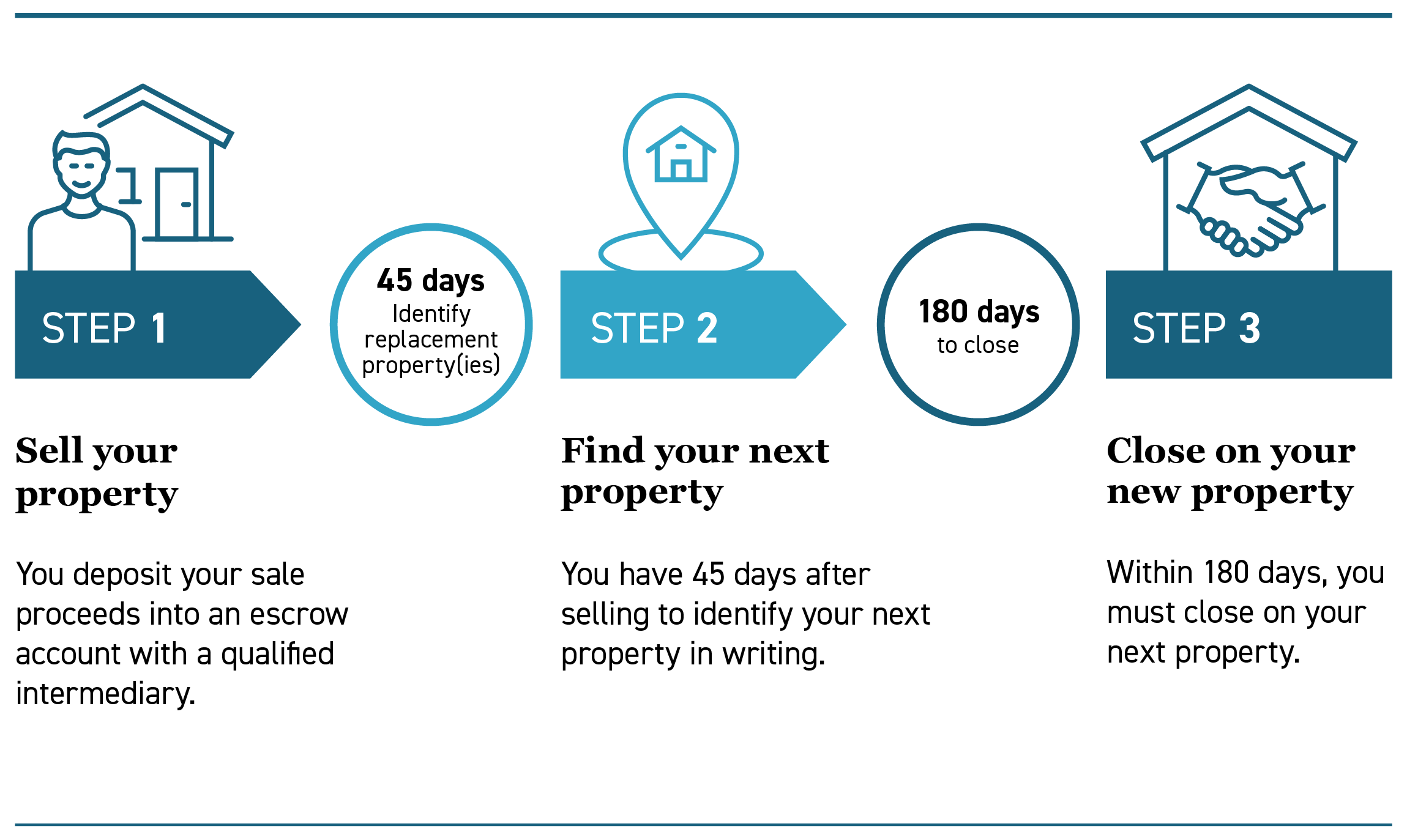

Real estate investors can sidestep costly capital gains taxes by completing a 1031 exchange. A 1031 exchange is a way for real estate investors to sell a property and reinvest the proceeds in a similar (or “like-kind”) property, deferring capital gains taxes that would otherwise be due upon the sale. It is named after Section 1031 of the IRS tax code and is also known as a “like-kind exchange.”

The Three-Step Process

Keep your money in motion–learn more about how to manage your real estate investments using tax-focused strategies

Decent Q4 makes it three straight years of double-digit returns. How about four in a row?

We wouldn’t call it a scorching Santa Claus rally, but the S&P 500 was able to hang on and post a positive total return of roughly 2.7% in Q4 2025. This put a nice cherry on top of another solid year for US equity investors. In calendar 2025, the S&P 500...

The November market pause just might set the table for a profitable 2026

The S&P 500 finished November up 0.2%, bringing year to date returns to 17.8% through month end. A flat month on the surface doesn’t quite capture the experience investors lived through, as it took a late-month rally to pull the index back to where it started....

Trick or treat: A mixed bag

October could best be described as a mixed bag: some good, some bad, but certainly eventful. The month’s headlines and market reactions once again reinforced our Clear Air Turbulence theme, as investors navigated through some spooky developments: renewed government...